The major branches of management and financial accounting share many similarities. Although both types of accounting produce financial information, managerial accounting requires more knowledge of accounting theory. Financial accounting standards are common for public companies and have some rules that must follow to present financial information consistently. The Financial Accounting Standards Board (FASB) has published a comprehensive set of accounting standards, including GAAP.

Principles and practices of managerial accounting

Management accounting principles provide insight into economic activities and support the achievement of strategic goals. The principles of managerial accounting allow organizations to develop a cost model that accurately reflects current costs. They also provide timely information that allows for flexibility within the organization. These principles can be found in the CGMA Competency Framework. These principles also give an overview of the profession's norms and values. Understanding and applying these principles can improve an organization's performance and efficiency. Here are some examples of how management accounting principles could help improve your company's performance.

The concepts of analogy, causality, and analogy are the basis of managerial accounting principles. The first principle is to relate the quantitative output of an managerial objective to its quantitative input quantity. Managers can use this principle to model and allocate costs to business activities. The second principle involves interpreting the information in light of various decision alternatives. This allows managers make the most informed decisions. Management-focused approaches that use both principles achieve the desired results and optimize company operations.

The goals of managerial accounting

Managerial accounting serves the main purpose of providing information to business owners, managers, and planners for internal decision making and planning. Managers rely on this information to make decisions. This information, while financial accounting data, does not give enough detail to enable managers to make the appropriate decisions. To provide managers with the necessary information to make informed decisions, it must be broken down into products and services. They should also be able perform what-if analyses in order to determine the best course.

Management accounting should arrange data in groups that are simple to understand. Data should be relevant and pertinent to the problem. The purchase figures could be organized by region, supplier or product. Furthermore, managerial accounting is a tool for communication. Managers need to know how the organization is performing against its budgets, operating plans, and standards. Managers should be notified if the organization is performing below their budgets or plans. Corrective action can be taken if necessary.

Management accounting: What is it?

Managerial accounting covers the interpretation and analysis of business data. Managers can use this information to make better decisions and maximise profits. Managers also use this information to make informed decisions regarding resource utilization and industry cycles. Managerial accounting is a wide-ranging field. These are just a few of the key characteristics of this type of accounting. These attributes make it an invaluable tool for managers. In addition, managerial accounting is the basis of financial accounting.

Management accounting is important to manage overhead costs. It allows you to assign costs based on the number of products you sell. It allows managers to assess the impact of cash flow decisions. Since most companies use accrual, it is often difficult to quantify the impact on cash flow of a single transaction. Managerial accountants plan for short-term transactions. They look at the profit trendslines and costs for different products.

Managerial accountants: What are the requirements?

Management accountants have a variety of job duties and require a diverse set of skills to be successful. Aside from being familiar with GAAP, they also need to be familiar tax principles and understand financial capital and human capital management. This job requires leadership skills and persuasive abilities. Strong communication skills are also required. Additional requirements include education in education technology and social networking.

Management accountants must have strong analytical skills to be successful in their roles. They should be able interpret and analyze financial data. Furthermore, they must be able communicate complex data both in writing and orally. They should also have high ethical standards, and they should be able show leadership. Management accountants must adhere to a number of standards. It is essential that they have a solid understanding of these principles in order to be successful.

FAQ

What are management concepts, you ask?

Management concepts are the principles and practices used by managers to manage people, resources. They cover topics such as job descriptions and performance evaluations, human resource policies, training programs, employee motivation, compens systems, organizational structure, among others.

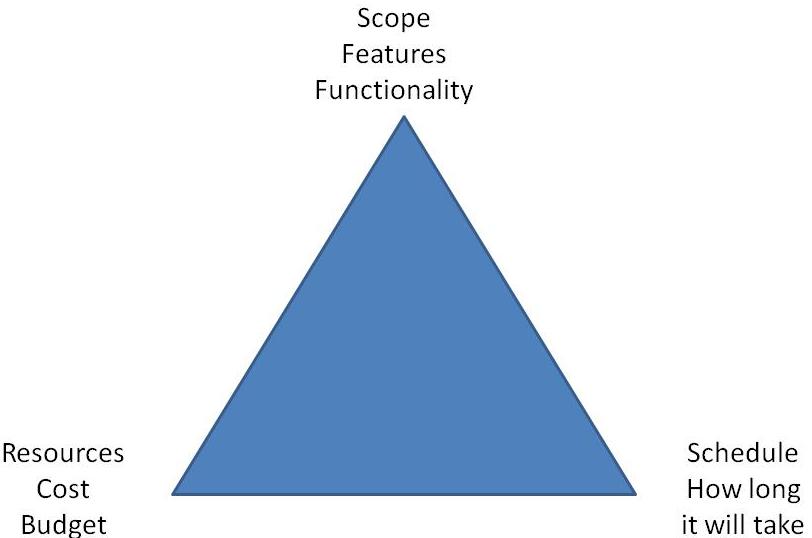

Why is it important for companies to use project management techniques?

Project management techniques ensure that projects run smoothly while meeting deadlines.

This is because most businesses rely heavily on project work to produce goods and services.

These projects must be managed efficiently and effectively by companies.

Without effective project management, companies may lose money, time, and reputation.

What is the best way to motivate your employees as a manager?

Motivation can be defined as the desire to achieve success.

Enjoyable activities can motivate you.

Or you can get motivated by seeing yourself making a contribution to the success of the organization.

For example, if your goal is to become a physician, you will probably find it more motivational to see patients rather than to read a lot of medicine books.

The inner motivation is another type.

Perhaps you have a strong sense to give back, for example.

You may even find it enjoyable to work hard.

Ask yourself why you aren't feeling motivated.

Then think about how you can make your life more motivating.

What is a management tool to help with decision-making?

The decision matrix is a powerful tool that managers can use to help them make decisions. It allows them to think through all possible options.

A decision matrix is a way to organize alternatives into rows and columns. This makes it easy to see how each alternative affects other choices.

The boxes on the left hand side of this matrix represent four possible choices. Each box represents one option. The top row displays the current situation, and the bottom row shows what might happen if nothing is done.

The effect of selecting Option 1 is shown in the middle column. It would translate into an increase in sales from $2million to $3million.

These are the results of selecting Options 2 or 3. These are good changes, they increase sales by $1million or $500,000. They also have negative consequences. Option 2 increases costs by $100 thousand, while Option 3 decreases profits to $200 thousand.

The final column shows the results for Option 4. This involves decreasing sales by $1 million.

The best thing about using a decision matrix is that you don't need to remember which numbers go where. The best thing about a decision matrix is that you can simply look at the cells, and immediately know whether one option is better or not.

The matrix already does all the work. It is as simple a matter of comparing all the numbers in each cell.

Here's an example of how you might use a decision matrix in your business.

You want to decide whether or not to invest more money into advertising. If you do this, you will be able to increase revenue by $5000 per month. You'll also have additional expenses up to $10,000.

You can calculate the net result of investing in advertising by looking at the cell directly below the one that says "Advertising." That number is $15 thousand. Advertising is more valuable than its costs.

Statistics

- Hire the top business lawyers and save up to 60% on legal fees (upcounsel.com)

- The profession is expected to grow 7% by 2028, a bit faster than the national average. (wgu.edu)

- As of 2020, personal bankers or tellers make an average of $32,620 per year, according to the BLS. (wgu.edu)

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

External Links

How To

How can you implement a Quality Management Plan?

QMP, which was introduced by ISO 9001:2008, is a systematic approach to improving products, services, and processes through continuous improvement. It helps to improve customer satisfaction and product/service quality by continuously measuring, analyzing, controlling and improving.

QMP stands for Quality Management Process. It is used to guarantee good business performance. QMP helps improve production, service delivery and customer relationships. QMPs should encompass all three components - Products and Services, as well as Processes. If the QMP only covers one aspect, it's called a "Process QMP". The QMP that focuses on a Product/Service is called a "Product." QMP. QMP is also used to refer to QMPs that focus on customer relations.

There are two key elements to implementing a QMP: Strategy and Scope. These elements can be defined as follows.

Scope: This defines what the QMP will cover and its duration. This scope can be used to determine activities for the first six-months of implementation of a QMP in your company.

Strategy: This describes the steps taken to achieve the goals set out in the scope.

A typical QMP includes five phases: Design, Planning, Development and Implementation. Each phase is explained below:

Planning: This stage identifies and prioritizes the QMP's objectives. To get to know the expectations and requirements, all stakeholders are consulted. Once the objectives and priorities have been identified, it is time to plan the strategy to achieve them.

Design: This stage is where the design team creates the vision, mission and strategies necessary for successful implementation of QMP. These strategies are executed by creating detailed plans.

Development: Here, the team develops the resources and capabilities that will support the successful implementation.

Implementation: This refers to the actual implementation or the use of the strategies planned.

Maintenance: Maintaining the QMP over time is an ongoing effort.

Additional items must be included in QMP.

Stakeholder involvement is important for the QMP's success. They should be involved in planning, design, development and implementation of the QMP.

Project Initiation: The initiation of any project requires a clear understanding of the problem statement and the solution. This means that the initiator should know why they want something done and what they hope for from the end result.

Time Frame: The time frame of the QMP is very critical. If you plan to implement the QMP for a short period, you can start with a simple version. If you are looking for a longer-term commitment, however, you might need more complex versions.

Cost Estimation is another important aspect of the QMP. It is impossible to plan without knowing what you will spend. Before you start the QMP, it is important to estimate your costs.

QMPs are not just a written document. They should be a living document. It evolves as the company grows and changes. It is important to review it periodically to ensure it meets all current requirements.