Model risk is a danger that can be caused by the use of inaccurate models. This risk is commonly associated with financial securities valuation. It is difficult to manage. Model risk is caused by unrealistic and inaccurate assumptions. It is a type of operational risk. However, model risk is an acceptable concern for financial institutions.

Model risk is a subset operational risk

Model risk is the potential for business to use predictive models. These models are valuable, but they can also be a risky investment. The implications of bad models can be extremely severe, so it is critical to manage this risk appropriately. This risk can be mitigated by machine learning.

Model risk is primarily a concern for the company that created and used the model. Incorrect or incomplete results can result in financial losses for the company.

It is caused because of incorrect and unrealistic assumptions

Incorrect assumptions and data may lead to inexact model results and wrong decisions. These errors can cause significant financial losses, poor decision making for an organisation, and damage to a company's reputation. Incorrect models affect various industries. Incorrect models can lead to inaccurate predictions about the possibility of terrorist attacks on planes or fraudulent credit card transactions. Model errors can result from bad data or programming errors.

Financial loss, regulatory penalties and reputational harm can all result from a model's failure. By enforcing governance and monitoring models, you can reduce the risk of model failure. However, model developers bear the responsibility for identifying model failures and assessing them.

It is a challenge to manage

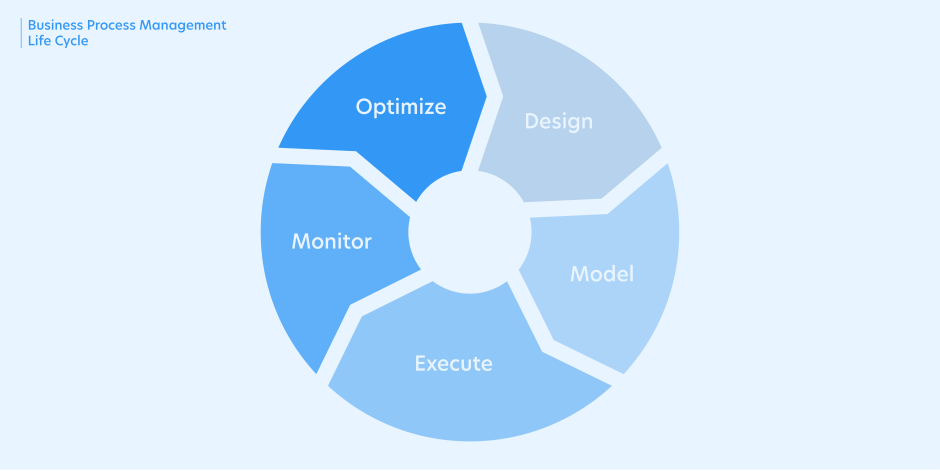

The risks associated with predictive models becoming increasingly integrated into business processes are increasing. While the benefits are great, the potential consequences of a bad model are equally significant. As such, Model Risk Management is essential to managing such risk. Proper governance and process can help organizations limit the risk associated with these models and enable sustainable growth in any vertical.

Good model risk management involves the creation of a well-structured model development, and then implementation process. Model governance policies should also be used for model risk management. Each member of the organization must be aware of potential consequences of model failure. Enterprise MLOps involves model risk management.

There are many ways to reduce model risk. However, it is not possible to eliminate it completely. You can manage it with other tools like monitoring model performance and analyzing model results in other ways. Effective model risk management requires a robust governance framework that identifies relevant risks and allocates resources appropriately. The framework should also include an internal audit team that can review models and make sure they comply with acceptable policies.

FAQ

What are the three basic management styles?

The three basic management styles are: authoritarian, laissez-faire, and participative. Each style has its advantages and disadvantages. What style do you prefer? Why?

Autoritarian - The leader sets direction and expects everyone else to follow it. This style is best when the organization has a large and stable workforce.

Laissez-faire – The leader gives each individual the freedom to make decisions for themselves. This style works best when the organization is small and dynamic.

Participative - The leader listens to ideas and suggestions from everyone. This is a great style for smaller organizations that value everyone.

What are the steps of the management decision-making process?

Managers are faced with complex and multifaceted decisions. It involves many factors, including but not limited to analysis, strategy, planning, implementation, measurement, evaluation, feedback, etc.

It is important to remember that people are human beings, just like you. They make mistakes. You are always capable of improving yourself, and there's always room for improvement.

This video will explain how decision-making works in Management. We discuss the different types of decisions and why they are important, every manager should know how to navigate them. You'll learn about the following topics:

It can sometimes seem difficult to make business decisions.

Complex systems are often complex and have many moving parts. People who manage them have to balance multiple priorities while dealing with complexity and uncertainty.

It is important to understand the effects of these factors on the system in order to make informed decisions.

It is important to consider the functions and reasons for each part of the system. It's important to also consider how they interact with each other.

You should also ask yourself if there are any hidden assumptions behind how you've been doing things. You might consider revisiting them if they are not.

You can always ask someone for help if you still have questions after all of this. They might have different perspectives than you, and could offer insight that could help you solve your problem.

Statistics

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

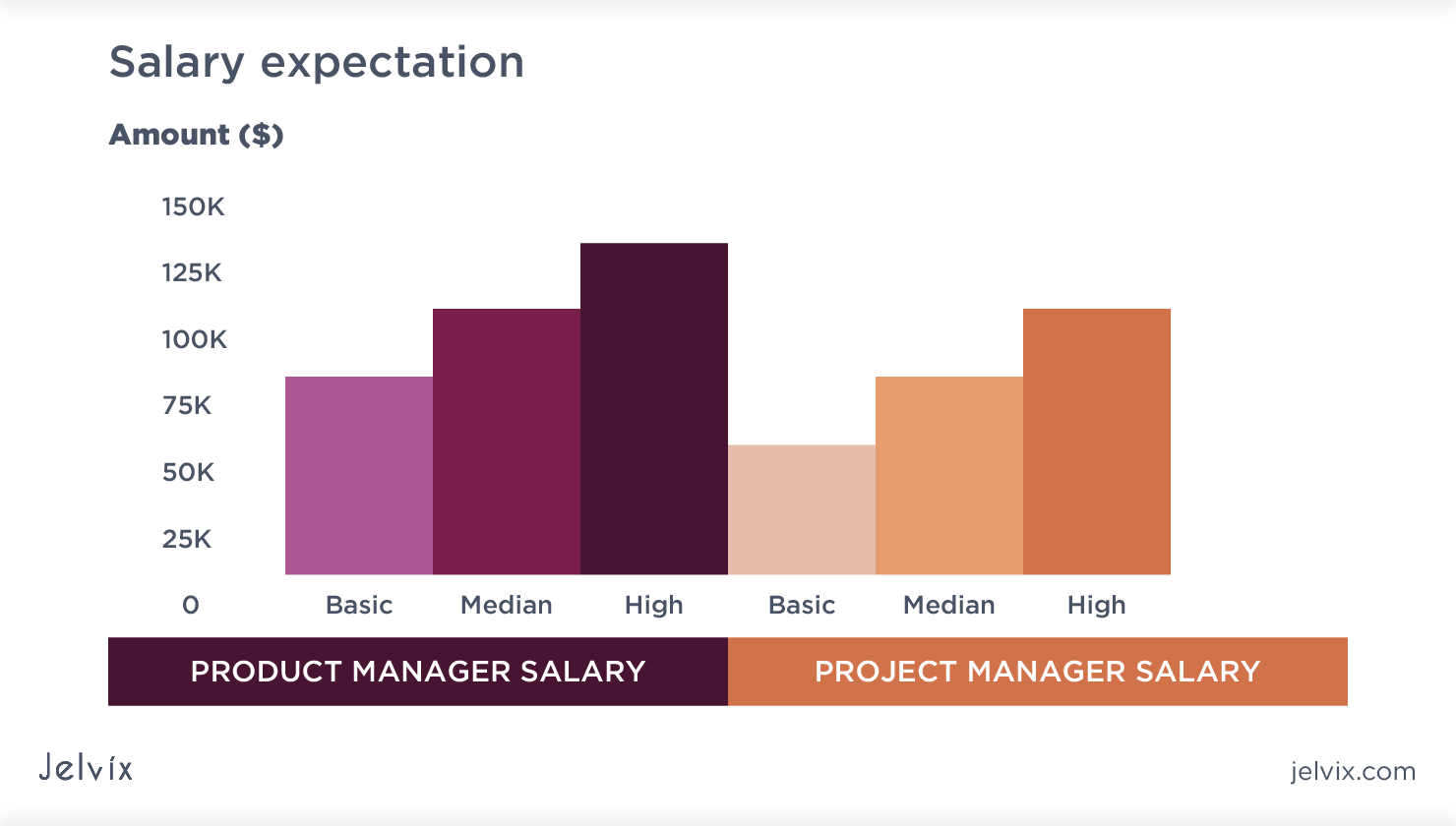

- The profession is expected to grow 7% by 2028, a bit faster than the national average. (wgu.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- This field is expected to grow about 7% by 2028, a bit faster than the national average for job growth. (wgu.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

External Links

How To

How can you implement Quality Management Plan (QMP).

QMP, which was introduced by ISO 9001:2008, is a systematic approach to improving products, services, and processes through continuous improvement. It is about how to continually measure, analyze, control, improve, and maintain customer satisfaction.

The QMP is a standard method used to ensure good business performance. QMP helps improve production, service delivery and customer relationships. A QMP should include all three aspects - Processes, Products, and Services. The QMP that only addresses one aspect of the process is called a Process QMP. QMP stands for Product/Service. QMP stands for Customer Relationships.

When implementing a QMP, there are two main elements: Scope and Strategy. These are the following:

Scope is what the QMP covers and how long it will last. This will be used to define activities that are performed in the first six months of a QMP.

Strategy: This describes how you will achieve the goals in your scope.

A typical QMP is composed of five phases: Planning Design, Development, Implementation and Maintenance. Here are the details for each phase.

Planning: This stage determines the QMP goals and prioritizes them. All stakeholders involved in the project are consulted to understand their requirements and expectations. After identifying the objectives, priorities and stakeholder involvement, it's time to develop the strategy for achieving the goals.

Design: This stage involves the creation of the vision, mission, strategies and tactics necessary to implement the QMP successfully. These strategies can be implemented through the creation of detailed plans.

Development: The development team is responsible for building the resources and capabilities necessary to implement the QMP effectively.

Implementation: This refers to the actual implementation or the use of the strategies planned.

Maintenance: Maintaining the QMP over time is an ongoing effort.

In addition, several additional items must be included in the QMP:

Participation by Stakeholders is essential for the QMP's continued success. They should be involved in planning, design, development and implementation of the QMP.

Initiation of a Project: A clear understanding and application of the problem statement is crucial for initiating a project. This means that the initiator should know why they want something done and what they hope for from the end result.

Time Frame: It is important to consider the QMP's time frame. If you plan to implement the QMP for a short period, you can start with a simple version. For a long-term commitment you may need more complicated versions.

Cost Estimation: Another important component of the QMP is cost estimation. Planning is not possible without knowing the amount of money you will spend. Therefore, cost estimation is essential before starting the QMP.

The most important thing about a QMP is that it is not just a document but also a living document. It changes as the company grows. It should therefore be reviewed frequently to ensure that the organization's needs are met.