Supply chain financing is a great way to help SMEs finance their operations. These financing options offer many advantages, such as early payment, lower credit risk and longer payment terms. It's also a fast way to get short term credit. This financing method is particularly useful for SMEs that may not be able to obtain bank loans.

Questions regarding supply chain financing

As a risky practice, supply chain finance has come under scrutiny recently. Although supply chain financing can be useful for companies that are healthy, it can mask a credit problem and lead to more debts. This is especially true when supply chain finance doesn't comply with GAAP disclosure requirements. This practice has been dubbed "hidden debt" by some media.

Supply chain finance is generally about financing activity and operating cash flow adjustments. Supply chain finance often involves reverse factoring. In this case, a seller will transfer an invoice to a purchaser. This enables the buyer and seller to work out payment discounts and timing for both parties. But supply chain finance services are not always easy to understand and can lead to legal and regulatory problems.

Suppliers are increasingly able to take advantage of early payment programs. But, suppliers must validate the reputation of the program they are participating in and evaluate its strength. Further, they need to ensure that a third-party is facilitating transactions and enforcing proper accounting treatment.

Requirements for applying for supply chain financing

Suppliers and buyers have the option to extend payment terms through supply chain finance. The supplier sends invoices and the buyer approves them. The lender may advance 100% of the invoice to the seller. Usually, the lender requires sellers to have a minimum two-year credit history.

A supply chain funding funder could be either a traditional lender or an alternative lending organization like Fintech. The documentation must show evidence of goods/services rendered and the amount owed. It should also list the parties involved. These documents should also provide information about the payment terms. This documentation can be used to improve the confidence of the funding provider when extending the loan.

The process to secure supply chain financing is often complex. Supply chain finance providers demand that suppliers meet certain financial and operational criteria in order to be able to meet capital requirements. A majority of these programs involve a Partner Financial Institution. This can be a bank entity or a nonbank entity. A number of requirements must be met for the Partner Financial Institution to meet national safeguards and ADB integrity guidelines. They also need to comply with prudential regulations and clearances from government agencies.

Key terms of supply chain financing

Supply chain finance is a financial instrument that helps companies meet their financial obligations. This involves funding financing that will help the company meet its business goals and adapting its operating cash-flows. This type of financing is more beneficial to larger companies and costs less than traditional financing. This type of financing is different from dynamic discounting, which uses a company's own funds to finance a supplier.

This financing allows companies to increase their working capital and pay suppliers more quickly. It can also reduce days of unpaid sales. This agreement can also help companies to better plan and forecast their cash flows. However, it's crucial that both parties fully understand the terms and conditions of the agreement before they agree to supply-chain financing. It's best that supply chain financing is used only when it makes the most sense.

Supply-chain finance programs generally record the payments in accounts payable rather than as debt. This helps a company's liquidity position look stronger than it really is. These programs increase a company's working cash without increasing its total borrowing. Investors may not be aware of some of their supply-chain risk.

FAQ

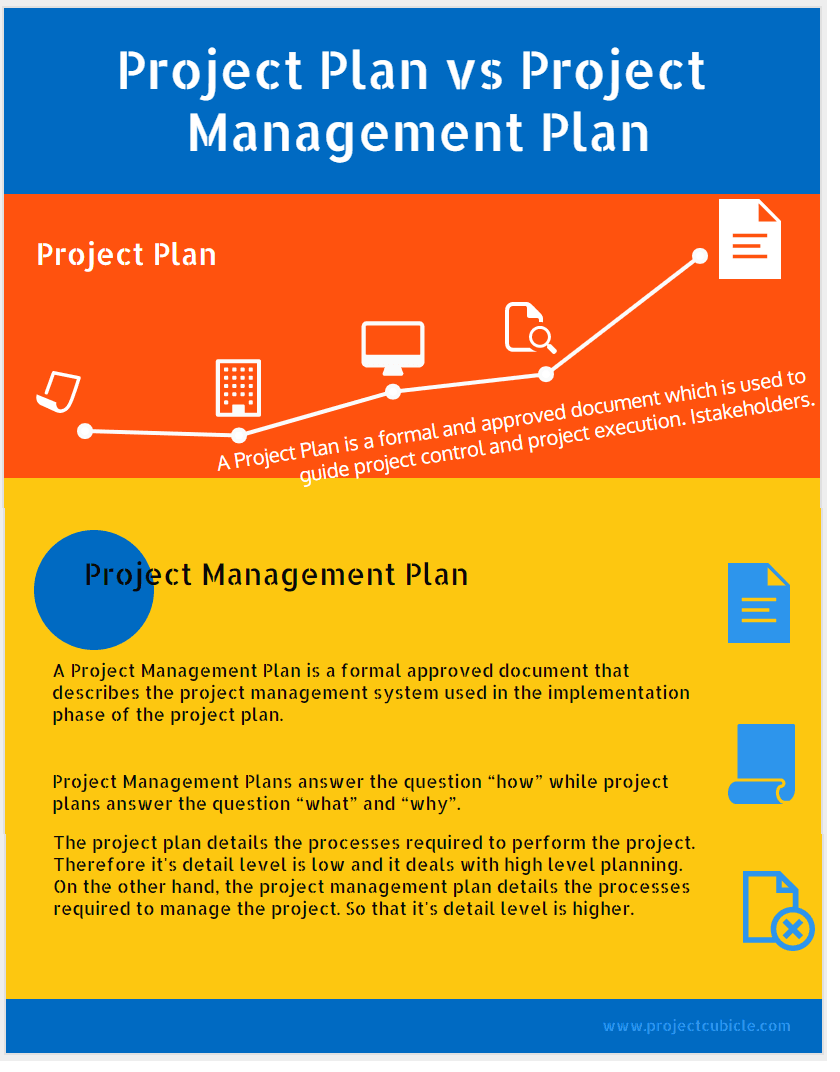

What do we mean when we say "project management"?

Management is the act of managing activities in order to complete a project.

We include defining the scope of the project, identifying the requirements, preparing the budget, organizing the project team, scheduling the work, monitoring progress, evaluating results, and closing down the project.

What are the most common errors made by managers?

Sometimes, managers make their job more difficult than it is.

They may not assign enough responsibilities to staff members and provide them with inadequate support.

Many managers lack the communication skills to motivate and lead their employees.

Some managers set unrealistic expectations for their staff.

Managers may choose to solve every problem all by themselves, instead of delegating to others.

What is a basic management tool that can be used for decision-making?

The decision matrix is a powerful tool that managers can use to help them make decisions. It allows them to think through all possible options.

A decision matrix allows you to represent alternatives as columns and rows. This makes it easy to see how each alternative affects other choices.

This example shows four options, each represented by the boxes on either side of the matrix. Each box represents one option. The status quo (the current condition) is shown in the top row, and what would happen if there was no change?

The middle column shows the effect of choosing Option 1. In this example, it would lead to an increase in sales of between $2 million and $3 million.

These are the results of selecting Options 2 or 3. These positive changes can increase sales by $1 million or $500,000. However, these also involve negative consequences. Option 2 can increase costs by $100 million, while Option 3 can reduce profits by $200,000.

The final column shows results of choosing Option 4. This means that sales will decrease by $1 million.

A decision matrix has the advantage that you don’t have to remember where numbers belong. The best thing about a decision matrix is that you can simply look at the cells, and immediately know whether one option is better or not.

This is because your matrix has already done the hard work. It is as simple a matter of comparing all the numbers in each cell.

Here's an example showing how you might use a Decision Matrix in your business.

It is up to you to decide whether to spend more money on advertising. By doing so, you can increase your revenue by $5 000 per month. However, additional expenses of $10 000 per month will be incurred.

The net result of advertising investment can be calculated by looking at the cell below that reads "Advertising." It is 15 thousand. Advertising is worth much more than the investment cost.

Statistics

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- This field is expected to grow about 7% by 2028, a bit faster than the national average for job growth. (wgu.edu)

- Our program is 100% engineered for your success. (online.uc.edu)

External Links

How To

How can you implement Quality Management Plan (QMP).

QMP, which was introduced by ISO 9001:2008, is a systematic approach to improving products, services, and processes through continuous improvement. It provides a systematic approach to improving processes, products and customer satisfaction by continuously measuring, analysing, controlling, controlling, and improving them.

QMP is a standard way to improve business performance. QMP's goal is to improve service delivery and production. QMPs should cover all three dimensions - Products, Processes, and Services. The QMP that only addresses one aspect of the process is called a Process QMP. QMP stands for Product/Service. The QMP that focuses on customer relationships is known as the "Customer" QMP.

Scope, Strategy and the Implementation of a QMP are the two major elements. These are the following:

Scope: This defines what the QMP will cover and its duration. For example, if your organization wants to implement a QMP for six months, this scope will define the activities performed during the first six months.

Strategy: These are the steps taken in order to reach the goals listed in the scope.

A typical QMP is composed of five phases: Planning Design, Development, Implementation and Maintenance. Each phase is explained below:

Planning: This stage identifies and prioritizes the QMP's objectives. All stakeholders involved in the project are consulted to understand their requirements and expectations. Next, you will need to identify the objectives and priorities. The strategy for achieving them is developed.

Design: The design stage involves the development of vision, mission strategies, tactics, and strategies that will allow for successful implementation. These strategies are then put into practice by creating detailed plans.

Development: The development team is responsible for building the resources and capabilities necessary to implement the QMP effectively.

Implementation involves the actual implementation using the planned strategies.

Maintenance: This is an ongoing process to maintain the QMP over time.

In addition, several additional items must be included in the QMP:

Participation of Stakeholders: The QMP's success depends on the participation of stakeholders. They should actively be involved during the planning and development, implementation, maintenance, and design stages of QMP.

Project Initiation: The initiation of any project requires a clear understanding of the problem statement and the solution. In other words, they must understand the motivation for initiating the project and the expectations of the outcome.

Time Frame: It is important to consider the QMP's time frame. A simple version is fine if you only plan to use the QMP for a brief period. For a long-term commitment you may need more complicated versions.

Cost Estimation: Another important component of the QMP is cost estimation. Planning is not possible without knowing the amount of money you will spend. Therefore, cost estimation is essential before starting the QMP.

The most important thing about a QMP is that it is not just a document but also a living document. It is constantly changing as the company changes. It should be reviewed on a regular basis to ensure that it is still meeting the company's needs.